Trump often whines about the mainstream press ignoring his economic accomplishments. He cites the current labor market as a shining example of his economic prowess. Is their distaste for him clouding their perspective of his stewardship over the jobs economy?

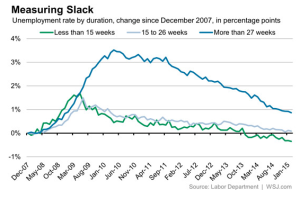

On the surface, this sounds like an easy question. We have an unemployment rate that has reached levels not seen in almost two decades at 3.9 percent. We are in the midst of positive job growth that has exceeded 91 months, which far exceeds the next longest recorded of 48 consecutive months that ended in 1990. Of course, Trump should get the lion’s share of the credit, right?

Hold on a second, it might not be so straight forward.

While Trump once proclaimed that he’ll be the “greatest job producer God has ever created”, he will need a more robust performance in 2018. Even though it was a good year, he fell 156,000 short of the 2.3 million jobs produced in Obama’s last year.

Even with an unemployment rate that has dipped below 4 percent, we are performing near the middle of our peers. Both Germany and Japan have lower unemployment rates with the United Kingdom not too far behind. America First… let’s try America Middle of the Road.

Maybe that’s not fair since the powers of the executive office are limited. Typically, it takes legislation that either reduces taxes or increases government spending to spur economic development. However, Trump faced significant push back from both political parties bitter at his antics and vitriol rhetoric. Thus, he was unsuccessful in achieving health care reform and could not pass tax reform until 10 months into his tenure. That is not soon enough to demonstrably change economic activity yet.

It is hoped that lower taxes for both industry and households will spur even more job creation. With previous statutory corporate tax rates the highest in the world, its drastic cut should incentivize more investment spending. The addition of more factories, equipment, and facility expansion offers more opportunities for construction workers and other blue-collar men and women who were drawn to his populist instincts. Then there’s the expectation that households will spend their extra $100-200 a month on goods and services and lead business to expand jobs even more.

That all sounds like a plausible strategy. The only problem is one of timing. Our economy was already performing near its peak and wasn’t in need of more stimulus. Instead of outpacing Obama-era jobs, my betting money is on it outpacing past deficits.

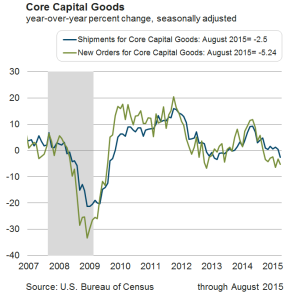

But then there’s the prospect of Trump going for broke and realigning the bonds of international trade. Concerned with bulging trade deficits and outsourcing of jobs, he has decided to disregard his economics background and tear up international agreements in favor of revisions that place American interests first.

That sounds good as he’s a populist where his ideas are ‘popular’ with the general public. However, a more nuanced look offers a less pleasant outcome. Let’s say the U.S. is able to achieve the most favorable scenario where the U.S. is able to bully both allies and foes to submit to our will (doubtful scenario, by the way), it will still result in higher prices for consumers and higher production costs for most U.S. producers.

For instance, let’s say the U.S. is able to negotiate more favorable terms where less Canadian lumber is imported into the U.S. Certainly, U.S. lumber producers will rejoice as they will see their profit margins widened and perhaps grow employment with less competition. But with their greater market power, they can impose higher supplier costs on construction and furniture companies. Those additional cost pressures will make job expansion less likely in those sectors and offset any gains from U.S. lumber.

That is the problem with the Trump Economic Doctrine. For every company that benefits from trade restrictions, many more will be hampered by it. In fact, we will see its negative effects locally as Southwest Georgia farmers are bracing to be hit hard. Renegotiating the free trade agreement with Mexico and Canada threatens their livelihood as their steady source of income are at risk. If the agreement is broken or revised to slow the flow of trade between our borders, that hurts farmers.

Let’s revert back to wages. Aren’t we seeing higher wages as proclaimed in Trump’s State of the Union? While it’s true that wages are rising, it is modest at best. In fact a look at the Atlanta Fed’s Wage Tracker shows that this year’s pace is falling behind last year’s. Mind you, that faster wage growth occurred without lowering taxes. Though businesses gave ‘bonuses’ to each workers as a token gesture in return for their financial largesse, Main Street America are still left with the scraps and the ‘promise’ for a better tomorrow.

Then there are the loyal administration supporters that point to the reduced regulatory red tape as being the primary driver to job expansion. It is accurate that President Trump was able to navigate beyond constitutional constraints to sign executive orders to minimize the burden of governmental regulation. He has also been helped by the morally challenged, but highly effective Environmental Protection Agency head Scott Pruitt who has rolled back many Obama-era rules protecting the environment.

This has been a boon for the manufacturing and banking sectors, who have seen their fortunes reversed. Even though employment numbers are up for both sectors, their overall impact is limited with their respective gains of 265,000 and 145,000 only representing a miniscule portion of the jobs created under the Trump era.

On the other hand, the rest of the regulatory framework has been pretty much untouched due to our impotent Congress. Thankfully, there have been no further changes to rules aimed at protecting workers and society in general. Amazingly, it hasn’t stopped other sectors from growing their employment numbers. That is because there are other forces at play that have nothing to do with regulation.

Both the U.S. and the world have been able to shed the debt incurred from the Great Recession. Combine that with monetary policy acts by former Fed Chairs Bernanke and Yellen (both Obama appointees) and both scenarios have juiced our recovery without stoking too much inflation (though Trump’s erratic foreign policy is trying to reignite those pressures). This has unleashed the less burdened consumer to spend more with businesses reacting by padding payrolls.

We have seen a reinvigorated Europe and global community that are spending more on U.S. products. It remains to be seen if the protectionist wave that has hit the United Kingdom will reverse this trend once they formally negotiate out of the European Union, but so far U.S. exporters are benefitting from enhanced trade.

In closing, let’s use a golf analogy as an aside to Trump’s favorite pastime. He suffered a bogey on the first hole as his health care reform fell flat on its face, but then gained momentum in the next few holes with the eventual passage of tax reform. The weather is perfect and the course is playing for a very low score. While shooting under par, there were many birdie opportunities missed. But ominous clouds appear overhead and playing conditions will definitely worsen. Does he have the steady hand and guile to guide us through the travails of an uncertain future?

In my mind, Trump is that unconventional amateur that has avoided hitting water so far and might make the cut to play through the weekend. But anyone thinking his simplistic, go-for-broke style is suited for the long haul is only fooling themselves.